With Foneloan, financial emergencies are handled effortlessly. Secure a loan instantly from your smartphone, with no paperwork, collateral, or bank visits required. Your loan, your terms, in just one tap!

Foneloan is your digital lending partner that enables you to get loan from your smartphone on-the-go. For the first time in Nepal, you can now get loan from your bank’s mobile banking app without any Collateral, Bank Visit or Paperworks through Foneloan.

These pre-approved loans are available to banking customers deemed eligible by an automated analytics system as per the criteria set by banks. You can avail Foneloan for cash emergencies including medical expenses, purchases, travel and education expenses.

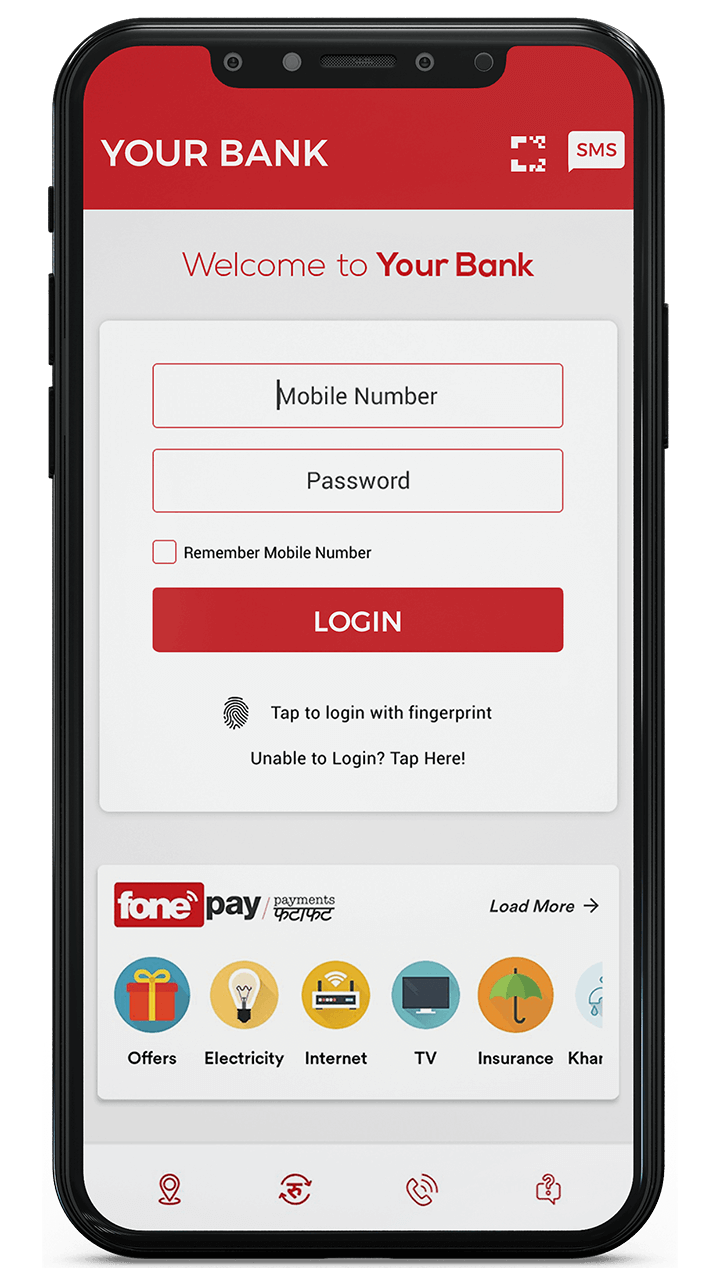

to your Mobile Banking app

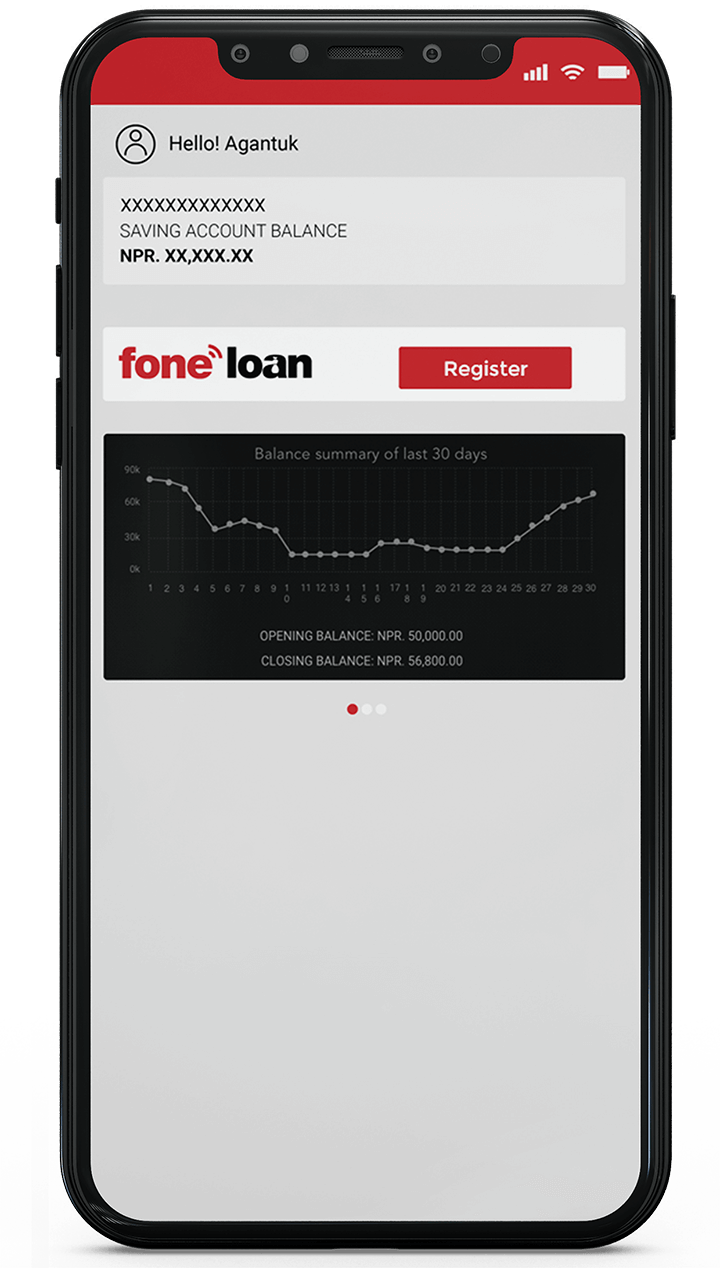

with your details

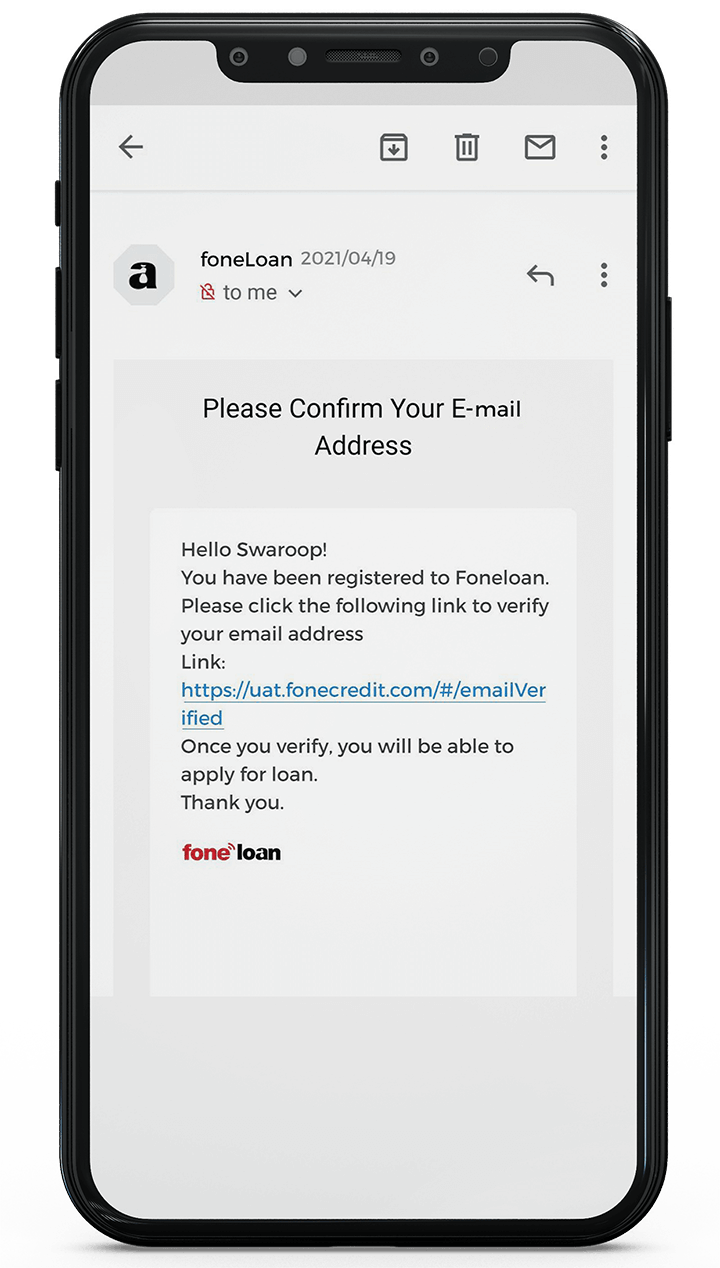

your email address

your desired loan amount

Access Foneloan for anything and everything you need or want.

Payday Loan is a digital lending service to provide small short term loans to customers instantly, through bank’s mobile banking application. The target customers are limited to salaried people, Fonepay and the banks are planning to extend the services to the other customer who has a passive source of revenue including rental income, pension, and others.

Learn MoreThese pre-approved loans are available to banking customers deemed eligible by an automated analytics system as per the criteria set by the bank. Be it for cash emergencies, meeting regular needs or fulfilling ones wishes, foneloan is readily and instantly available to banking customers, anytime anywhere.

Learn More

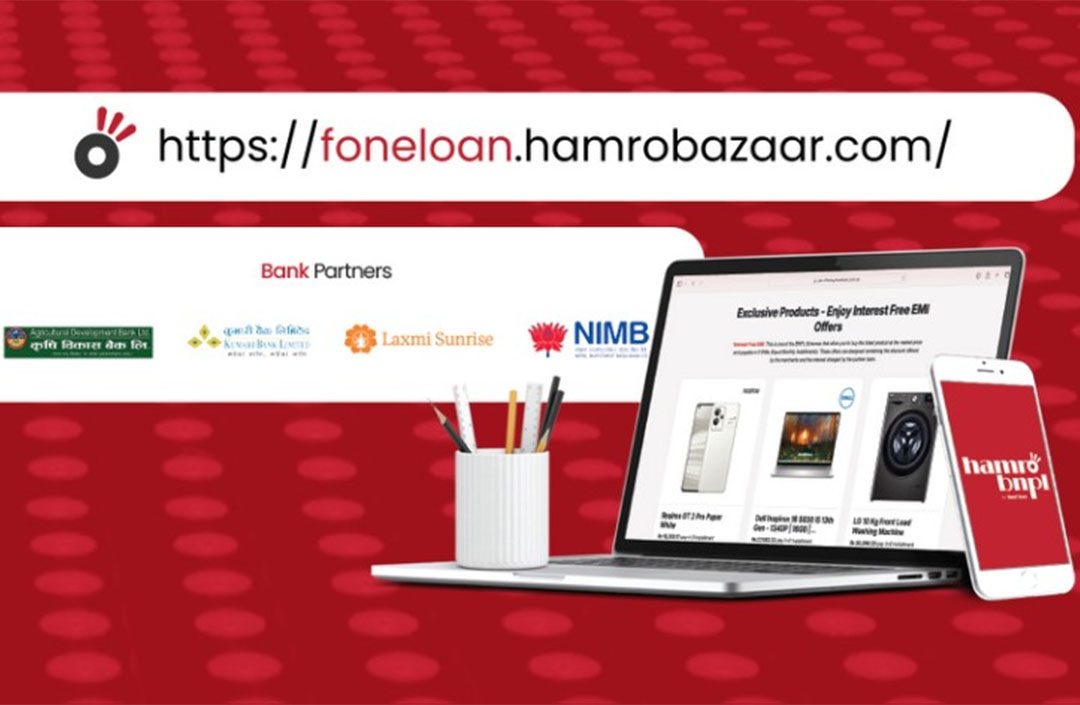

HamroBNPL is a Buy Now, Pay Later feature offered by Foneloan in partnership with Hamrobazaar, Nepal’s largest online marketplace, that empowers eligible Foneloan customers of partner banks to enjoy a more convenient and budget-friendly shopping experience.

Learn MoreTotal Registered Customers

No. of Loans Disbursed

Loan Amount Disbursed

We have been closely working with F1soft from the beginning. The innovativeness and revolution in Digital Financing brought about by F1soft is surging and Foneloan is one of the examples. We launched Foneloan through Kumari Smart app around October 2020. Previously, there was only a 1 month payment modality in Foneloan. However, with the higher demand and understanding the need of the eligible customers, now Kumari Bank offers Foneloan in EMI and at the same time, customers can Buy Now, Pay Later while scanning QR to make purchase at any Fonepay merchant.

Foneloan is quick, reliable, and convenient, which can be utilized as a backup fund at the time of emergencies and also to fulfill the customers’ desire then and there. The collateral-free instant loan is cheaper and neither requires bank visit nor any documentation. We encourage bank’s payroll account holders to avail Foneloan digitally from Kumari Smart app in just a few clicks whenever you need and wherever you need. Foneloan, an instant loan at your fingertips.

I am overwhelmed to find such an amazing instant loan service which is quick to apply and easy to pay. The instant loan service that was available in one month modality has evolved to EMI loan, Buy Now Pay Later facility. The concept of buying now and paying at customer’s convenience has instilled confidence amongst customers like me that Nepalese banking is striving towards being at par if not better than international banking practices in terms of digitization of financial services. With your great hospitality and sincere service, we look forward to more such innovative features in days to come. On behalf of all customers, I would like to extend my appreciation to Kumari Bank for this endeavor and wish them the best for the future.

Still have queries?