In today’s fast-paced financial landscape, life is inherently unpredictable, marked by unforeseen emergencies and unexpected expenses that require immediate financial attention without warning. Whether it’s addressing a sudden medical expense or coping with unexpected home repairs, people need access to quick money. In such conditions when you are short of money, taking out a loan can be an effective way to handle the situation. Similarly, when you are running low on budget while planning a holiday or seizing a limited-stock opportunity like the latest phone, gaming console launch or taking advantage of time-sensitive offers during festivals and campaigns, getting an instant loan can help you fulfill your wish. However, in the present context of Nepal, the loan application process is marked by substantial obstacles creating difficulties for potential borrowers. With a traditional lending system, the applicants often have to go through extensive paperwork, documentation requirements, and prolonged processing times. Even when the borrower requires the smallest amount of loan, they have to go through complex processes to get their loan amount approved. Moreover, most financial institutions don't even provide a small amount of loan.

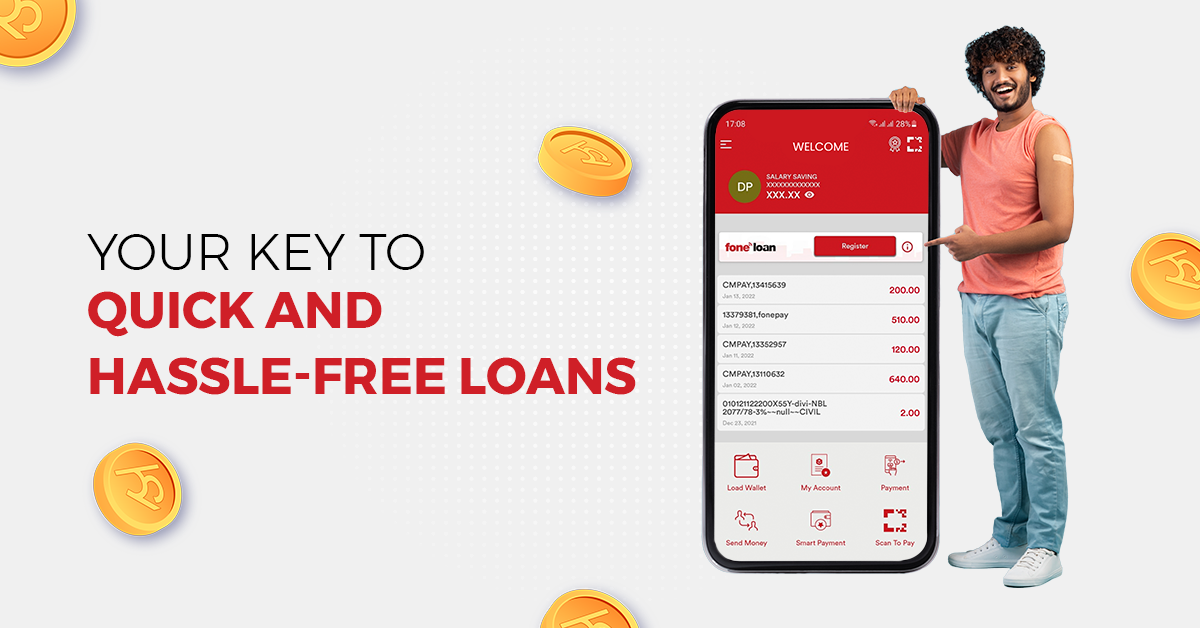

In these scenarios, financial institutions that offer low documentation requirements, no paperwork hassle, and instant approval play a crucial role in reducing the stress associated with unexpected financial demands. Living in a world where financial needs can arise unexpectedly, having access to quick and hassle-free loans is a game-changer. This is where Foneloan steps in to provide a timely and hassle-free solution for your urgent financial requirements. Whether it be the smallest amount of just Rs. 500 or the highest amount up to Rs. 2 lakhs, you can easily get it through Foneloan instantly. In this article, let’s explore how Foneloan can be your key to swift and trouble-free loans.

Foneloan is a digital lending platform designed to provide individuals with instant and seamless access to funds. Understanding it in depth, it is a digital financing product for banks that provides small short-term loans to banks' customers through mobile banking. In contrast to conventional lenders, Foneloan uses cutting-edge technology to streamline the lending process making it more efficient and user-friendly. In addition to this, Foneloan distinguishes itself through its commitment to providing not just instant short-term loans but a seamless financial experience. Below are some benefits of Foneloan which makes it a go-to solution for those seeking an instant short-term loan.

One of the standout features of Foneloan is its instant loan processing. Within just a few taps from the mobile banking app, customers can get the required amount of loan within their loan limit set by the Foneloan system. In a world where time is of the essence, Foneloan understands the urgency and ensures that eligible borrowers receive funds promptly. Foneloan's pre-approved loan feature adds a touch of simplicity to borrowing, making it an excellent choice for those seeking a stress-free and efficient lending experience.

While a traditional lending process requires hectic paperworks for the processing loan, Foneloan's online application platform eliminates all the paperwork requirements. Bid farewell to the cumbersome paperwork associated with processing loans. Foneloan eliminates documentation requirements, making the application process quick.

Foneloan recognizes that every borrower is unique. Hence, it offers flexible repayment options, allowing individuals to choose plans that align with their financial capabilities.

Foneloan is not just a platform where customers get instant short-term loan access but also provides hassle-free financial experience. Moreover, the platform streamlines the application process, ensuring that borrowers can navigate it with ease. From application submission to loan disbursement, Foneloan's mechanism is designed to save time and eliminate unnecessary hassles. Customers can register and apply for Foneloan directly through their mobile banking app. It uses analytical software which is used to identify the eligibility of customers, based on the criteria set by the banks. Furthermore, the software also uses the transaction history of customers as a parameter for setting the loan limit. The customers can avail loans within their pre-approved Foneloan limit.

The loan approval occurs seamlessly through an automated process, and the loan amount is promptly deposited into the customer's bank account, ensuring the entire procedure is efficiently concluded within a few minutes. Besides, Foneloan provides a flexible repayment option. Customers who apply for the loan can choose to pay back in a month or in Equated Monthly Installments. Additionally, Foneloan offers a feature called "Buy Now Pay Later" which can be used to make credit payments. Any customer who has already registered for any of Foneloan’s services can use the Buy Now, Pay Later model to make the purchase at any merchant who accepts Fonepay QR. Like other services available through Foneloan, the customers can get collateral-free, paperless, and faster loans through Buy Now, Pay Later as well. These pre-approved loans are available to banking customers deemed eligible by the Foneloan system as per the criteria set by banks. The customer can choose to pay back in a month or in Equal Monthly Installments.

If you are eligible for a loan, you will see the Foneloan banner on your mobile banking app. You will then have to register by clicking on the register button. Once you have registered for Foneloan, you can easily apply for a required amount of loan within your loan limit. Here is the step-by-step guide for applying loan through Foneloan.

Step 1: Open your mobile banking app. You will see the Foneloan banner on your mobile banking app dashboard. Click on the “Apply” button.

Step 2: Enter the required loan amount within the loan limit.

Step 3: Choose a flexible payment option that suits you and enter EMI payment start date.

Step 4: Check the loan details and the terms of service and click on “Proceed”.

Step 5: Enter the CVV code sent to your SMS inbox.

Step 6: The loan amount will be credited to your account instantly.

Still have queries?